Corporate tax rate reductions are often viewed as catalysts for technological innovation and company growth. Several studies support this perspective, including:

- "How do tax reductions motivate technological innovation?" This study analyzes data from A-share listed companies between 2008 and 2019 and concludes that tax cuts stimulate companies' research and development (R&D) activities, leading to increased innovation.

- "Taxation and innovation" This study suggests that taxes significantly influence innovation. Properly designed tax systems can foster technological progress and economic growth by aligning private incentives with the social value of innovation.

The reverse, however, is also true: technological innovation in tax planning can reduce corporate tax liabilities, aiding businesses in optimising their tax positions while ensuring compliance.

Group relief and the UK corporate tax system

The United Kingdom's corporation tax group relief rules allow tax losses suffered by one company to be transferred to another company in the same group. The basic principle is that the claimant company that receives the surrendered losses can offset these losses against its profits, thereby reducing its profits chargeable to corporation tax.

Navigating group relief rules is complex, particularly for large corporate groups with subsidiaries that have non-coterminous accounting periods or have one or more joiners/leavers. Many companies rely on manual calculations, which consume valuable time and introduce a risk of suboptimal allocation, potentially leaving tax savings on the table.

Uncovering tax savings: An example

Consider a simplified scenario involving four companies within a group:

A, B, C, and D are in a 75% group relationship

To further simplify we use time apportioned by reference to months. In practice, this should be made by reference to days.

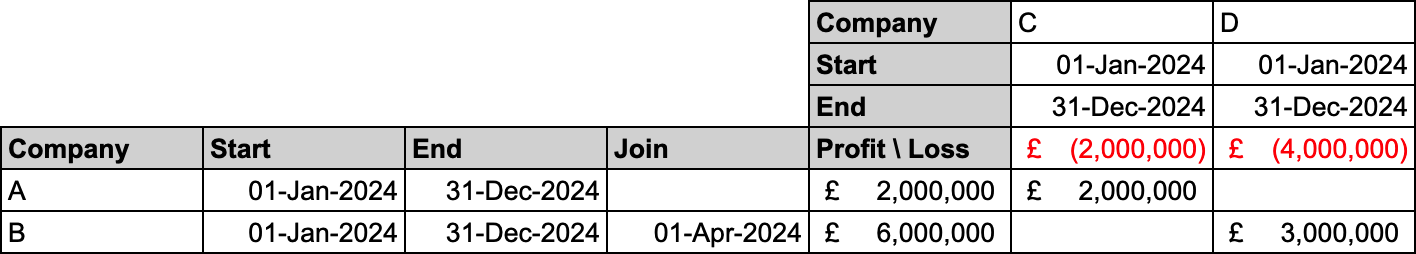

A manual approach might allocate losses as follows:

- A claims £2,000,000 from C (the maximum transfer allowed).

- B claims £3,000,000 from D (the maximum time-apportioned transfer allowed).

Total remaining profits: £3,000,000.

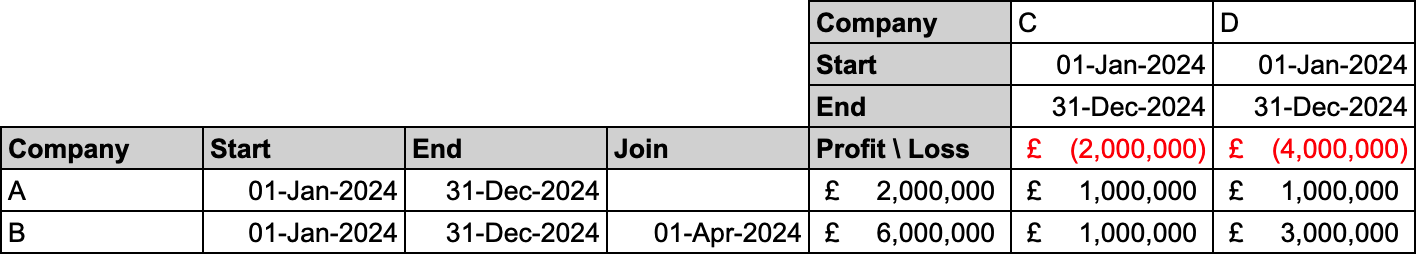

While this solution may look optimal at first glance (both group relief allocations were maximised), there is still an opportunity to further reduce the remaining profits by an additional £1,000,000:

- B claims £1,000,000 from C.

- B claims £3,000,000 from D (the maximum time-apportioned transfer allowed).

- A claims £1,000,000 from C.

- A claims £1,000,000 from D.

Total remaining profits: £2,000,000.

This example highlights how even relatively simple groups benefit from group relief optimisation. Manual methods can leave savings in taxable profits untapped, whereas optimising group relief with AI can identify optimal sequences that ensure maximum efficiency and compliance. For a breakdown of the calculations, check here.

Introducing GroupTax.ai

Recognising the complexities inherent in group relief and the potential for optimisation, we developed GroupTax.ai—an AI-powered tool designed to:

- Validate group relief matrices, ensuring compliance with legislative rules.

- Optimise group relief allocations to maximise tax savings.

- Provide actionable insights within seconds, transforming how corporate tax professionals manage group relief.

By leveraging advanced mathematical algorithms, GroupTax.ai addresses the limitations of manual calculations, which are often time-consuming and prone to suboptimal outcomes.

The future of tax optimisation

As tax regulations and company groups evolve, companies need smarter, faster, and more precise solutions. GroupTax.ai enables companies to unlock hidden tax savings, reduce compliance risks, and free up capital that can fuel innovation and growth.

We recognise that corporate tax optimisation extends beyond group relief. We're keen to collaborate with companies and accountancy firms to explore other corporate tax optimisation opportunities. If you're interested in smarter tax strategies, then let's connect!